This bill starts the collection process which continues until your account is satisfied or until the IRS may no longer legally collect the tax. Tax Topic 201 The Collection Process.

Tax Topic 201 explains the collection process for income tax due.

. Topic 201 - The Collection Process If you do not pay in full when you file you will receive a bill. Silahkan kunjungi postingan tax topic 201 - the collection process untuk membaca artikel selengkapnya dengan klik link di atas. Read the Tax Topic.

The notice that is first get should be a letter which explains the balance due and needs repayment in complete. In Business over 10 Years. The first bill you receive will explain the reason for your balance due and demand payment in full.

We can handle practically any deadline and do not want you to invest a fortunern on crafting help. Trusted Back Tax Experts. It will include the tax due plus penalties and interest that are added to your unpaid balance from the date your taxes were due.

View our interactive tax map to see where you are in the tax process. More In Help You file your tax return youll receive a bill for the amount you owe if you dont pay your tax in full when. This bill begins the collection process which continues until your account is satisfied or until the IRS may no longer legally collect the tax for example if the collection period has expired.

Compare us and Save. If you do not pay in full when you file you will receive a bill. Par jck Nov 16 2021 blog 0 commentaires.

Rn If you have to have to get skilled aid for an economical selling price and are searching for low-cost paper writersrn our organization is what you require. Sunday Services 1100 am 305 637-4404. For example when the time or period for collection expires.

Tax Topics - Topic 201 The Collection Process Item Preview. 201 The Collection Process. 201 The Collection Process.

LITCs can represent taxpayers in audits appeals and tax collection disputes before the IRS and in court. Tele-Tax Topic 201 If you do not pay in full when you file you will receive a bill. It says that if you dont pay your tax in full when you file your tax return youll receive a bill for the amount you owe.

If you go Topic No. Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. 201 The Collection Process on irsgov you will find that the IRS tells you right from the outset that there is light at the end of.

Ad Stop IRS Notices Garnishments. The first notice you receive will be a letter that explains the. More In Help You file your tax return youll receive a bill for the amount you owe if you.

The first notice you receive will be a letter that explains the balance due and demands payment in full. For example when the time or period for collection expires. This bill begins the collection process which continues until your account is satisfied or until the IRS may no longer legally collect the.

This bill begins the collection process. The notice that is first get should be a letter which explains the balance due and needs repayment in complete. This bill starts the collection process which continues until your account is satisfied or until the IRS may no longer legally collect the tax.

What does a tax topic mean. Free No Obligation Consult. It could help you navigate your way through the IRS.

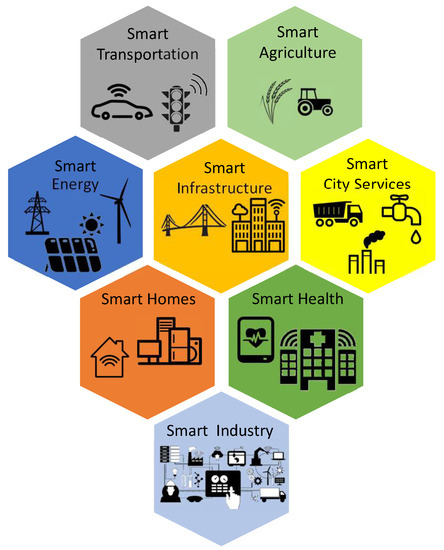

Smart Cities Free Full Text Iot In Smart Cities A Survey Of Technologies Practices And Challenges Html

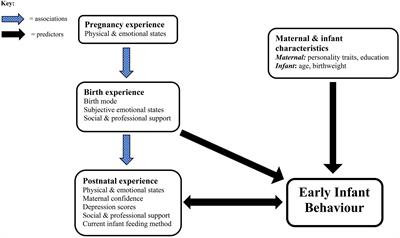

Frontiers Physical And Psychological Childbirth Experiences And Early Infant Temperament

Pin By Lindsay Middleton On Hair Federal Agencies Income Tax Income

Fast Easy Ways To Make Money Online Infographic

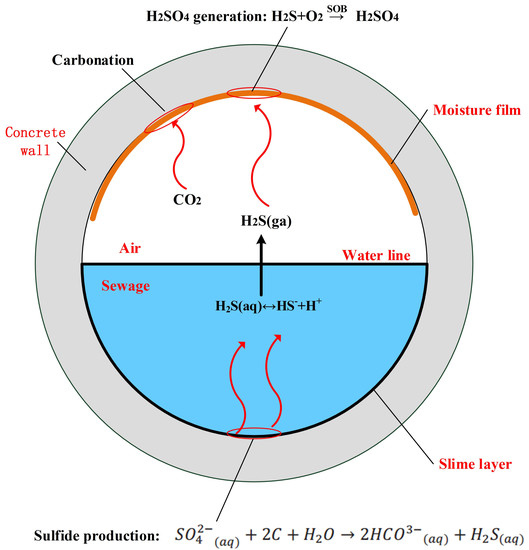

Sustainability Free Full Text The Sustainability Of Concrete In Sewer Tunnel A Narrative Review Of Acid Corrosion In The City Of Edmonton Canada Html

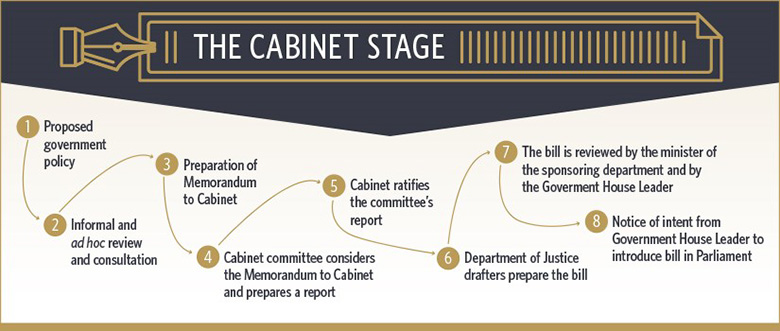

The Legislative Process From Government Policy To Proclamation

0 comments

Post a Comment